Rumored Buzz on Palau Chamber Of Commerce

Wiki Article

Getting My Palau Chamber Of Commerce To Work

Table of Contents10 Easy Facts About Palau Chamber Of Commerce DescribedFacts About Palau Chamber Of Commerce UncoveredRumored Buzz on Palau Chamber Of CommerceSome Ideas on Palau Chamber Of Commerce You Need To KnowGetting My Palau Chamber Of Commerce To WorkSee This Report about Palau Chamber Of Commerce10 Simple Techniques For Palau Chamber Of CommerceThe Buzz on Palau Chamber Of Commerce

To discover extra, check out our short article that talks even more comprehensive concerning the main nonprofit funding sources. 9. 7 Crowdfunding Crowdfunding has turned into one of the essential methods to fundraise in 2021. Therefore, nonprofit crowdfunding is getting the eyeballs these days. It can be used for details programs within the company or a basic donation to the cause.During this step, you may intend to consider milestones that will certainly suggest a chance to scale your nonprofit. Once you have actually run awhile, it is very important to spend some time to believe regarding concrete growth objectives. If you have not already created them throughout your planning, develop a collection of crucial performance indications and also milestones for your not-for-profit.

The Palau Chamber Of Commerce Diaries

Resources on Starting a Nonprofit in various states in the US: Beginning a Not-for-profit Frequently Asked Questions 1. Exactly how much does it set you back to begin a not-for-profit organization?

Some Known Details About Palau Chamber Of Commerce

With the 1023-EZ kind, the handling time is commonly 2-3 weeks. Can you be an LLC as well as a nonprofit? LLC can exist as a not-for-profit minimal liability company, nevertheless, it ought to be entirely possessed by a solitary tax-exempt not-for-profit organization.What is the difference between a foundation as well as a not-for-profit? Structures are commonly moneyed by a family members or a company entity, yet nonprofits are funded through their incomes and fundraising. Structures generally take the cash they began with, invest it, and afterwards distribute the cash made from those investments.

Palau Chamber Of Commerce Can Be Fun For Anyone

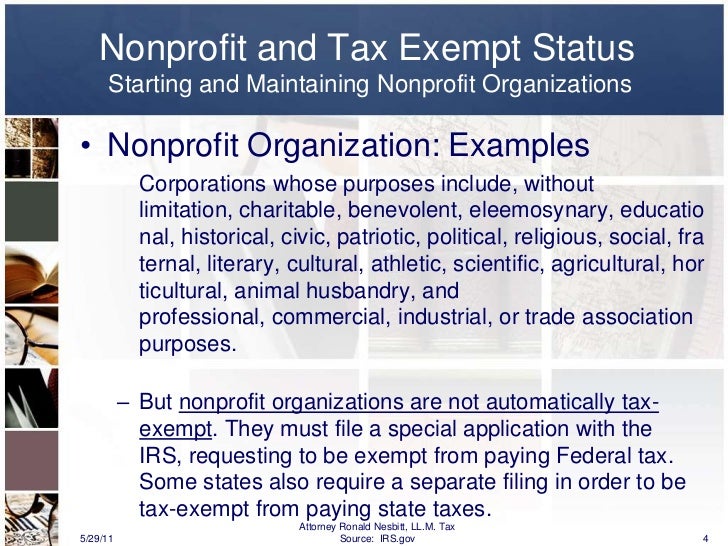

Whereas, the additional money a not-for-profit makes are used as operating expenses to fund the organization's objective. This isn't always true in the situation of a foundation. 6. Is it difficult to start a not-for-profit organization? A not-for-profit is a service, but beginning it can be quite extreme, needing time, clearness, as well as money.There are a number of actions to begin a not-for-profit, the obstacles to entry are relatively few. Do nonprofits pay taxes? If your nonprofit makes any kind of revenue from unassociated tasks, it will certainly owe revenue taxes on that amount.

Some Known Facts About Palau Chamber Of Commerce.

Twenty-eight various sorts of nonprofit companies are recognized by the tax legislation. By much the most typical type of nonprofits are Section 501(c)( 3) organizations; (Area 501(c)( 3) is the component of the tax code that accredits such nonprofits). These are nonprofits whose goal is philanthropic, spiritual, academic, or clinical. Section 501(c)( 3) company have one significant benefit over all various other nonprofits: contributions made to them are tax obligation insurance deductible by the donor.

The Only Guide for Palau Chamber Of Commerce

The bottom line is that private structures obtain a lot worse tax treatment than public charities. The main distinction in between personal structures and public charities is where they get their monetary support. A private foundation is generally managed by a private, household, or corporation, as well as obtains most of its revenue from a couple of benefactors as well as investments-- an excellent instance is the Expense and also Melinda Gates Structure.

Some Ideas on Palau Chamber Of Commerce You Should Know

A lot of structures just offer money to various other nonprofits. As a sensible issue, you need at least $1 million to start a private structure; or else, it's not worth the problem and expenditure.Other nonprofits are not so fortunate. The IRS initially presumes that they are personal foundations. Nonetheless, a new 501(c)( 3) organization will be categorized as a public charity (not a personal structure) when it makes an application for tax-exempt standing if it can reveal that it reasonably can be expected to be publicly supported.

Get This Report about Palau Chamber Of Commerce

If the internal revenue service identifies the not-for-profit as a public charity, it keeps this status for its first 5 years, despite the public support it really receives throughout this time around. Palau Chamber of Commerce. Starting with the not-for-profit's sixth tax obligation year, it should reveal that it fulfills the public assistance test, which is based on the support it obtains throughout the current year and also previous 4 years.If a not-for-profit passes the test, the internal revenue service will certainly remain to check its public charity condition after the first 5 years by requiring that a finished click to read more Arrange A be submitted every year. Palau Chamber of Commerce. Learn even more about your nonprofit's tax status with Nolo's my review here publication, Every Nonprofit's Tax Guide.

Report this wiki page